Automated FBR Reporting, The Complete Guide for Pakistan Businesses Pakistan businesses face strict reporting requirements from the Federal Board of Revenue. Manual reporting often creates delays, errors, and compliance gaps. Automated FBR Reporting solves these problems with real time data flow, accurate calculations, and secure filing. This guide explains how it works and what your […]

FBR Coping: Complete Guide for Businesses in Pakistan Pakistan’s tax environment is going through rapid digital transformation. Companies of every size are required to comply with modern tax rules introduced by the Federal Board of Revenue. Many businesses still struggle with FBR Coping, especially when it comes to digital invoicing, reporting, and real-time data management. […]

FBR Integration in Pakistan – Seamless Tax & Invoicing Compliance for Retailers & Enterprises In today’s rapidly evolving tax landscape in Pakistan, businesses — especially retailers, wholesalers and enterprises — must stay compliant while also optimising operations. The term “Federal Board of Revenue (FBR) Integration” refers to the process of connecting your billing, Point-of-Sale (POS) […]

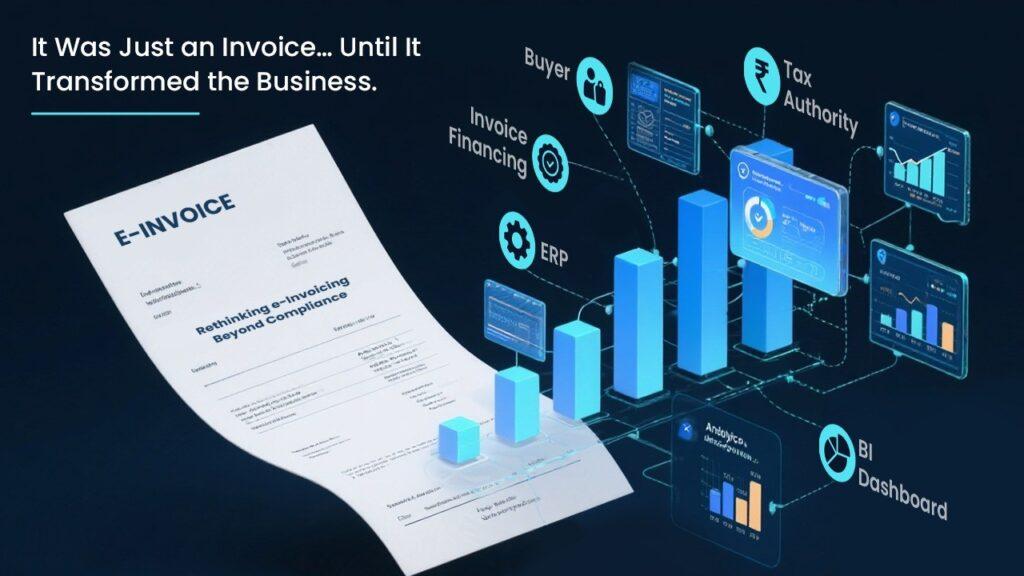

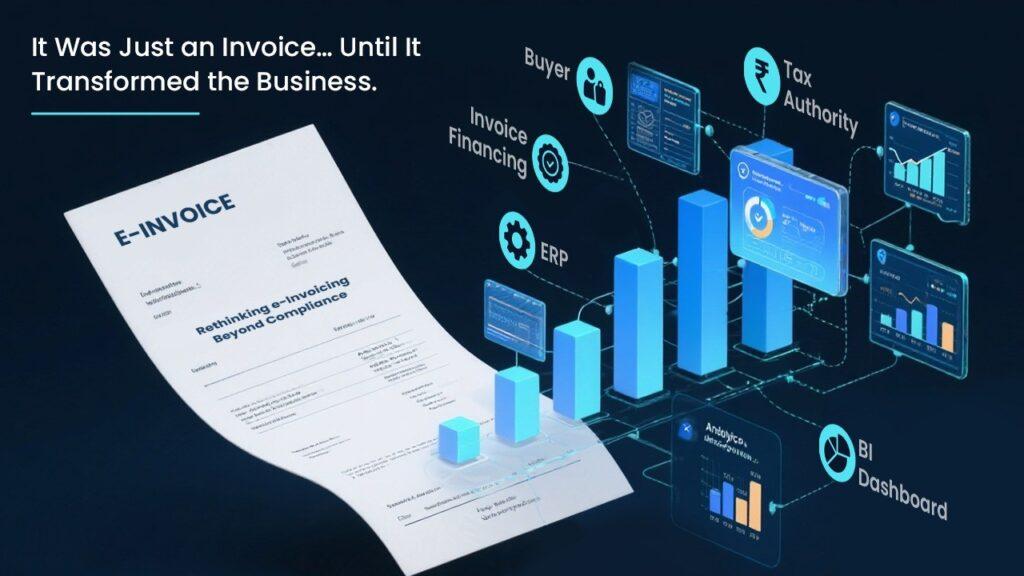

Electronic Invoice Validation System: A Complete Guide for Modern Businesses In today’s fast-paced, compliance-driven digital economy, businesses face increasing pressure to ensure their financial operations are accurate, transparent, and compliant with government regulations. One of the most powerful tools in this landscape is the Electronic Invoice Validation System (EIVS). Whether you’re a small enterprise or […]

E-Billing with FBR Integration: Transforming Invoicing in Pakistan In the ever-evolving landscape of digital transformation, E-Billing with FBR Integration has emerged as a critical compliance tool for businesses in Pakistan. With FBR (Federal Board of Revenue) mandating electronic invoicing under FBR POS and Tier-1 Retailer regulations, enterprises must adopt e-billing solutions that comply with tax […]

Digital Invoice Submission (FBR): A Game-Changer for Pakistani Businesses As Pakistan embraces digital transformation, the Federal Board of Revenue (FBR) has introduced Digital Invoice Submission to modernize tax compliance and prevent tax evasion. For businesses across the country, especially those in retail, wholesale, manufacturing, and services, this initiative is more than just compliance—it’s a shift […]

FBR Invoice Automation: The Future of Digital Invoicing in Pakistan In recent years, Pakistan has undergone a massive transformation in its tax and financial ecosystem through the Federal Board of Revenue (FBR) Invoice Automation System. As digitization becomes the norm, companies are rapidly transitioning from manual, paper-based invoicing to automated digital solutions that align with […]

FBR Digital Invoicing SRO: Your Ultimate 2025 Compliance Guide In today’s evolving digital economy, the Federal Board of Revenue (FBR) in Pakistan continues to modernize taxation processes. Among the most impactful regulations is the FBR Digital Invoicing SRO, which governs how businesses issue, report, and share invoices with tax authorities in real-time. This blog explores […]