Digital Tax Compliance PK: Ensuring Efficient Tax Management in Pakistan – CT Products The digitalization of tax systems in Pakistan is transforming how businesses report and comply with tax obligations. Digital Tax Compliance PK refers to the integration of electronic systems for the submission, tracking, and management of tax-relate data. With initiatives like the […]

FBR Coping: Complete Guide for Businesses in Pakistan Pakistan’s tax environment is going through rapid digital transformation. Companies of every size are required to comply with modern tax rules introduced by the Federal Board of Revenue. Many businesses still struggle with FBR Coping, especially when it comes to digital invoicing, reporting, and real-time data management. […]

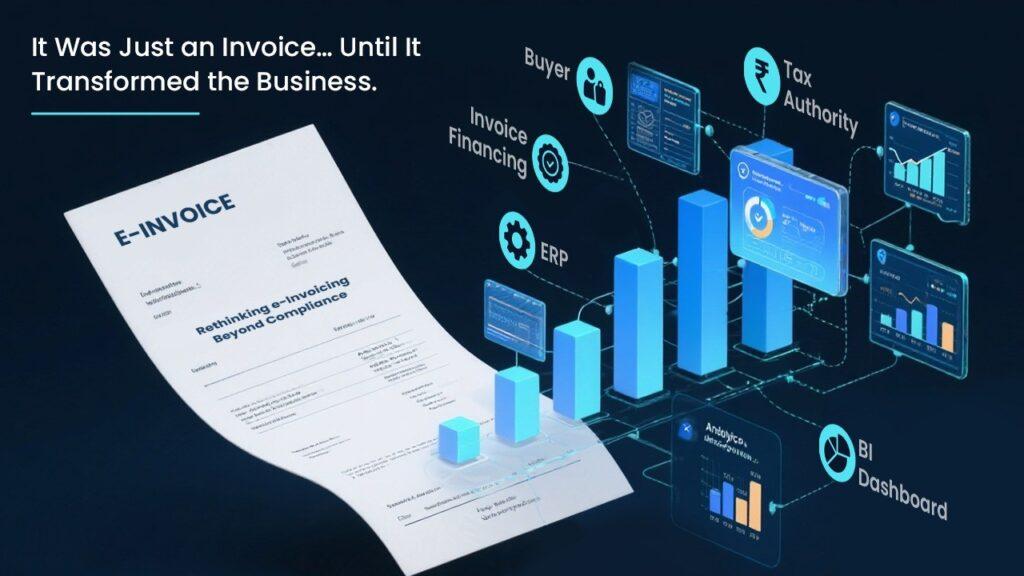

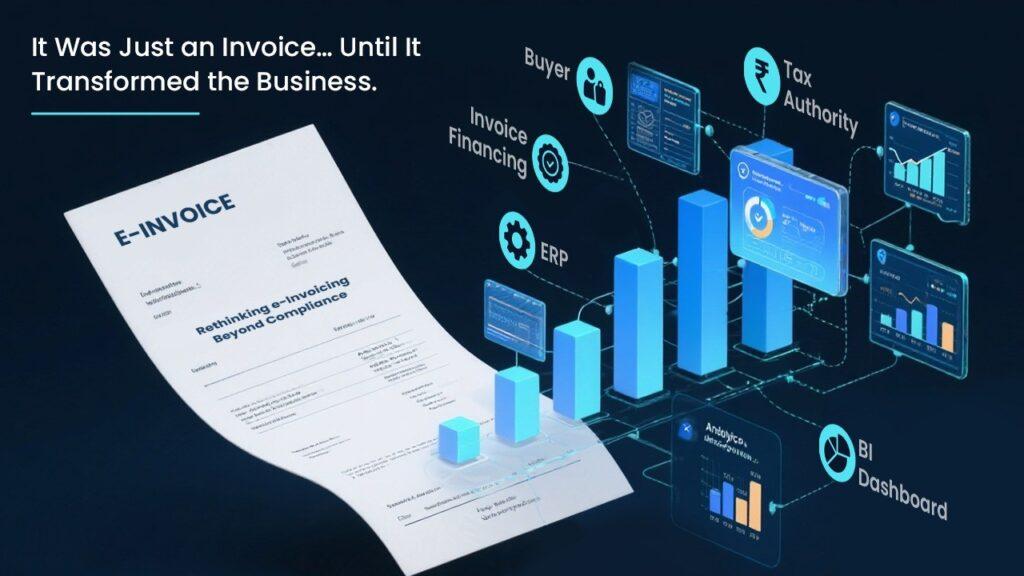

E-Billing with FBR Integration: Transforming Invoicing in Pakistan In the ever-evolving landscape of digital transformation, E-Billing with FBR Integration has emerged as a critical compliance tool for businesses in Pakistan. With FBR (Federal Board of Revenue) mandating electronic invoicing under FBR POS and Tier-1 Retailer regulations, enterprises must adopt e-billing solutions that comply with tax […]